Jeff Hoover has witnessed the evolution of loyalty programs since the early 2000s firsthand. The director of strategy and data insights for Paytronix, a leading loyalty vendor in the retail and foodservice space, has worked in customer engagement roles across several industries for two decades.

Hoover — who at one point was a digital marketing consultant for BP-owned convenience store Thorntons — noted that small and mid-sized c-store retailers originally got into loyalty simply to leverage rebates and competitively price their products.

“I don't think there was [much] thinking given to ‘How should I make the most value out of my loyalty program[?],’’” Hoover said in an interview.

However, a lot has changed in recent years as c-store retailers become more in tune with their customers.

As they seek more customer data to help improve their operations, many retailers have launched tier systems within their existing loyalty programs to gain a stronger following.

“You see all the value things can bring by just getting to know the customer better and remarketing to them and creating tiered programs,” Hoover said. “I think [retailers are] starting to model and then evolve these programs into more depths that drive more participation with customers.”

Customer data is gold

Circle K, RaceTrac and Sheetz are three well-known c-store retailers whose loyalty programs feature a tiered structure.

While regular members of Circle K’s Inner Circle program receive discounts on fuel and merchandise, they can upgrade to a premium membership, which includes more exclusive deals and early notice of new products once the customer spends $500 at Circle K stores. The retailer saw 1.2 million enrollments in the new membership program just three weeks after its limited debut in Florida.

Similarly, RaceTrac’s loyalty program offers members a VIP status, which includes 10 cents off per gallon of fuel on their first 40 gallons and 3 cents off per gallon on each additional gallon purchased every month. A VIP membership costs $2.49 per month.

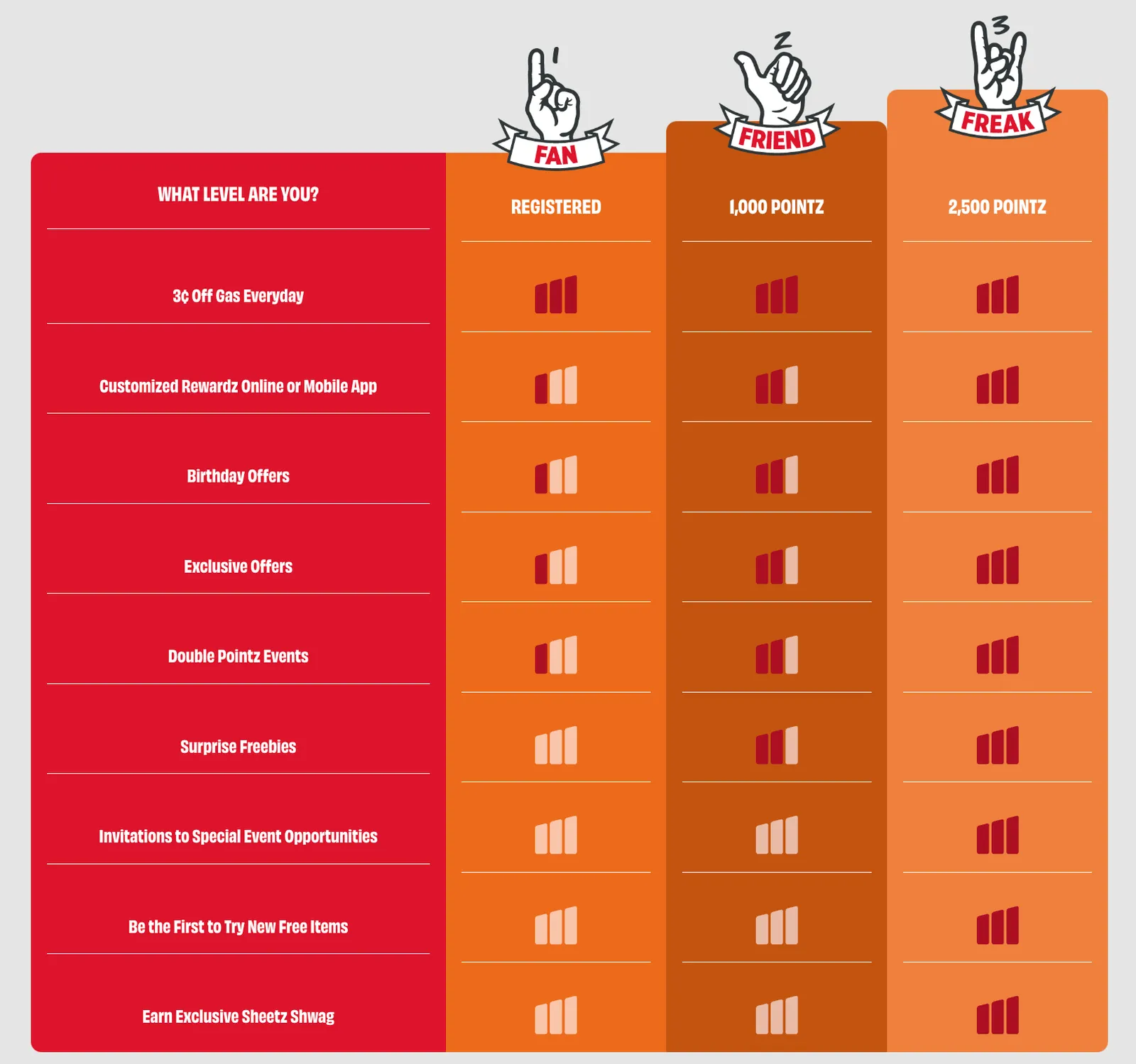

Sheetz’s loyalty platform is structured a bit differently. The Pennsylvania retailer offers three tiers to its loyalty program: Fans, Friends and Freaks. Customers become Fans simply by registering for the program, are updated to Friends upon reaching 1,000 loyalty points and hit Freak status once they reach 2,500 points. Every level includes more deals and perks, such as invitations to special events, free and exclusive items, and Sheetz merchandise.

While all three platforms differ in their details, they’re all structured on a tier system that, for c-store retailers and customers, is a “win-win,” Matt Sargent, director of strategy analytics for Sargent Up North and a former director of loyalty analytics for CPG consultancy Big Chalk, said in an interview.

Sargent noted that tiered programs invest in a brand’s most loyal customers while “holding a little back” from more infrequent visitors. This makes for an “attractive tool” to compel more people to not only visit the c-store, but also to join the program as well, he said.

“Everyone is looking to have bigger engagement with their customers, and when you can get people to invest in a brand either emotionally, financially, time-wise or whatever that commitment may be, it tends to have ripple effects in very positive ways,” Sargent said.

However, Hoover emphasized the importance of acknowledging and showing value to lower-frequency customers when developing a tiered system. These are the shoppers who have room to grow with the brand, and are the ones who can help grow the program, he said.

“To be able to understand exactly who is buying your product, why they're buying it and in conjunction with other brands or categories, that's gold.”

Matt Sargent

Director of strategy analytics for Sargent Up North

Tiered loyalty programs also have a gamification element to them, which consumers are naturally drawn to, Sargent noted. Specifically, having a “next level up” is something that resonates with human behavior and “makes perfect sense” in a loyalty program.

For retailers, tiered loyalty programs offer a better sense of who their customers are and what they’re buying. This can help them create a better connection with their visitors, Sargent said.

Once retailers have this shopper data, they can rework their merchandising strategies and even offer said data to CPG brands, which are also hungry for this information.

“To be able to understand exactly who is buying your product, why they're buying it and in conjunction with other brands or categories, that's gold,” Sargent said.

Baby steps

The first step to creating a tiered loyalty program is understanding how well customers are currently engaging with the brand, Hoover said.

If overall engagement is less than 5% participation in an existing loyalty program, it’s too early to even consider tiers, he noted. In this case, retailers must refocus on training and operations instead of advancing their loyalty programs.

Once that engagement reaches about 15% to 20%, then the tier conversations can begin, he said.

“Think about the maturity of your program, and if now is the right time for tiers or, honestly, should you be stepping back?” Hoover said.

When it’s time to build the tiered program, “keeping it simple” is essential, Hoover noted. He suggests picking one or two things that customers can comprehend and a concept staff can understand and communicate to shoppers.

“You still have your ‘earn 20 points per dollar spent in the store and 10 points per gallon,’ but then if you get to five or 10 visits a month, you're going to be in our gold tier,” he said.

But how do retailers pick that concept? Finding the clusters in existing customer behaviors is a place to start, Sargent said.

“You're going to have a high velocity of people that are already doing close to the behavior you want,” he said. “You take your high-level people and say, ‘Hey, you're already doing this behavior — do you want to continue doing X, Y, Z, and reach X status?’”