Frank Beard works in marketing at Rovertown and writes The Road Ahead, C-Store Dive’s monthly column. Guest columnist Brandon Lawrence is a longtime oil and gas data scientist and the founder of Fuel Insight, a data consultancy.

There’s been a steady push over the past decade to rebrand the convenience store industry as anything but gas stations. C-stores became convenience retailers, then came community stores and talk of restaurants that just happen to sell gas. The language keeps evolving, as if the right phrase might shake off the baggage of selling motor fuels and recast the industry in a more modern light.

Now we’re even hearing about “mobility retail” — a consultant-crafted term for a reality that exists only in PowerPoint presentations.

But here’s the truth: Gasoline remains the keystone category of the American convenience store. Remove it, and you don’t just change the margin profile — you change the customer base, traffic patterns, real estate logic and the business itself. Not much makes sense without it.

We made this case a year and a half ago, and it still holds up in 2025.

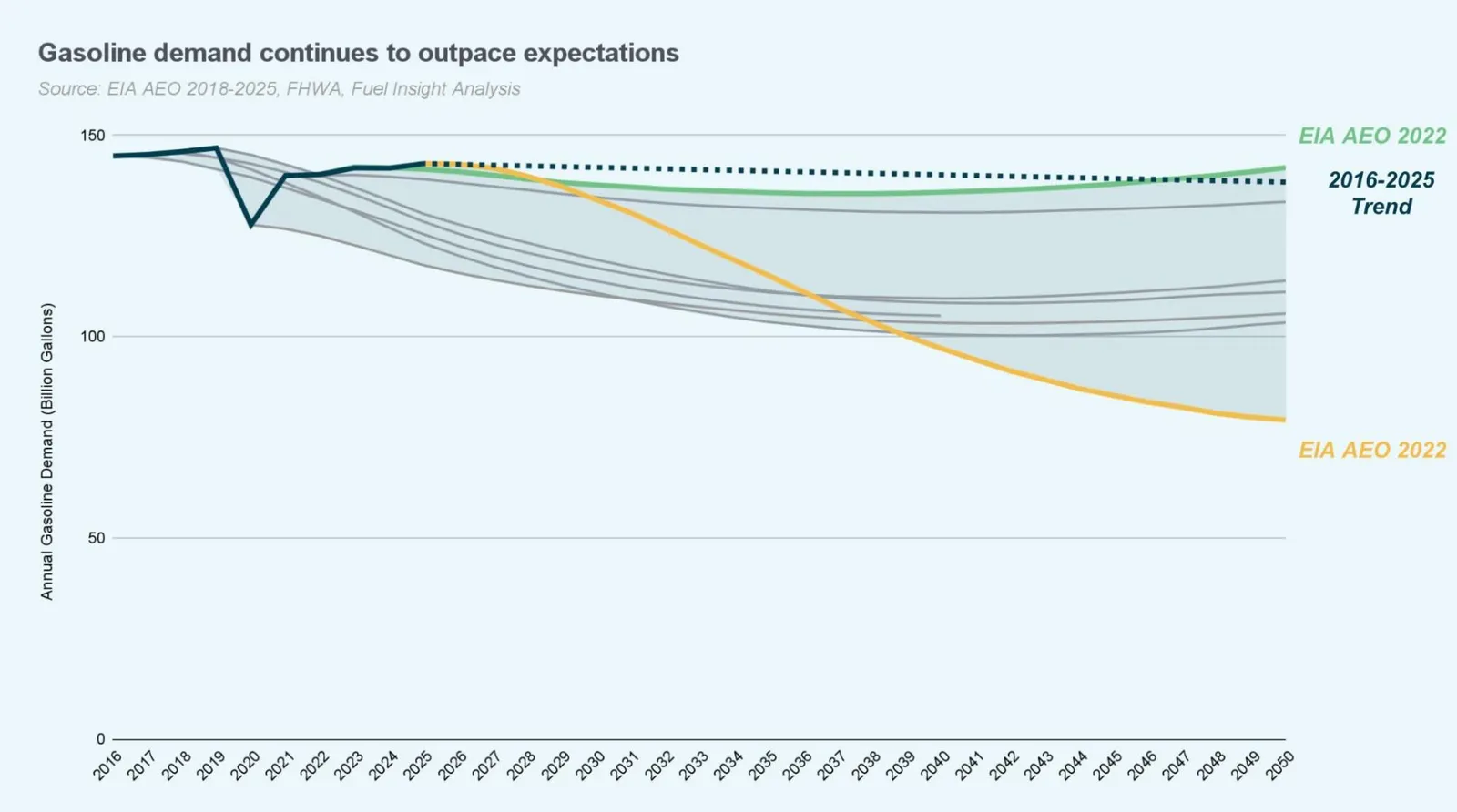

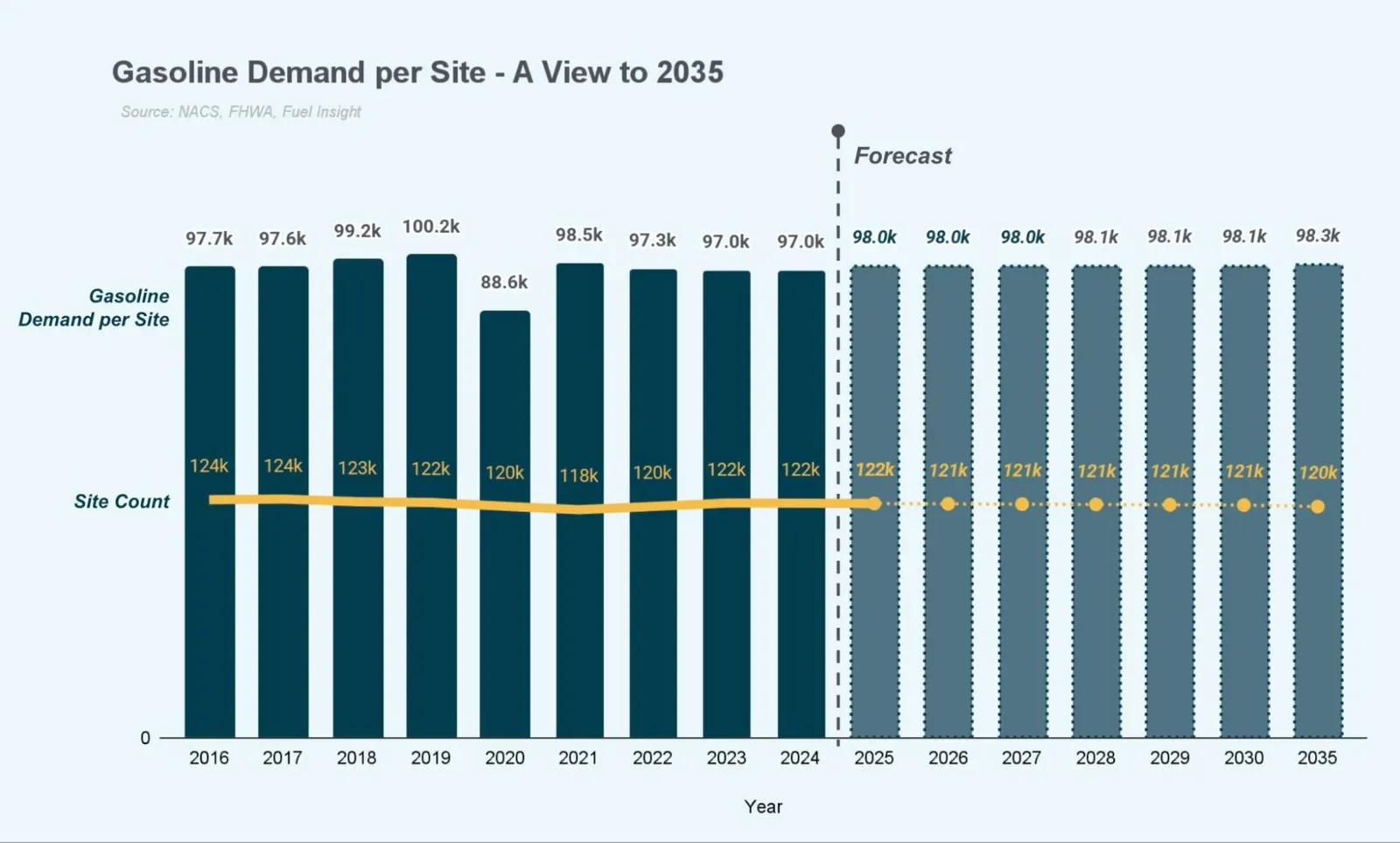

For nearly a decade, a popular narrative has been “the death of gasoline is five years away.” Yet as we approach 2030, the U.S. economy still runs on fuel. According to a Fuel Insight analysis, 2025 demand is projected to be just 2%-3% below 2019 levels — far from the 5%-10% declines that have been predicted for over a decade. Actual demand has outpaced consensus forecasts consistently across time horizons, a variety of regulatory regimes and fundamental changes in the global economy. Looking to 2050, if current trends hold, we should expect to remain between 90%-95% of pre-COVID highs. Gasoline remains the backstop for American growth.

Of course there are headwinds, as there have always been. But even during COVID — the largest economic shock in modern history — annual demand fell just over 10%. Americans kept filling up despite remote work, mass migration and economic disruption. By 2021, demand recovered to 95% of 2019 levels, despite lingering COVID impacts across the globe. Gasoline demand has proven to be one of the most resilient, inelastic forces in American life.

That’s also why fuel pricing is so competitive: the pump is the rare place where consumers express price sensitivity. They might care if gas is $3.29 or $3.59, but they’re buying either way.

The real story is how efficiently the industry has adapted. Over the past decade, average site volume declined just 0.13% annually, while site counts fell 0.16% — a near one-to-one relationship. Weaker operators exited, consolidation accelerated and new store growth continued.

COVID allowed the industry to reset cost structures, recalibrate and consolidate at scale. The result is a more rational, resilient environment than the cutthroat, low-margin stretch of 2010 to 2019. What once looked like slow rationalization now looks like a strategic advantage. It’s a model built not just to weather volatility, but to grow through it. At the center of that model sits the fuel canopy.

And the success of the convenience store depends on it.

According to 2024 NACS State of the Industry data released in April, when fuel gross profit is stripped from store operating profit, only the top three deciles of the industry are profitable. And that likely understates fuel’s role in driving inside sales.

If gas stations are going to remain as central to American life in the decades ahead as they’ve been in the past, maybe it’s time to reclaim the phrase instead of avoiding it.

The keystone category

It’s no accident that the typical American convenience store is attached to a fuel canopy instead of a sidewalk. The merging of the 24/7 convenience store and the fuel business in the 1980s and 1990s was a structural response to the realities of American life: car dependence, zoning codes, long distances and sprawling suburbs.

And yet, the idea persists that the future of convenience means leaving fuel behind. A 2022 panel on the “future of convenience” at Groceryshop featured one now-bankrupt, gentrified take on convenience and another that is built for dense, high-income neighborhoods in New York City. That same year, one company held a design competition to “reimagine the highway gas station” as a roadside oasis for EVs. The winning concept featured modular retail spaces that could be configured as yoga studios, pool halls and other amenities. It was more or less a strip mall in disguise.

Even the industry’s best operators have struggled to decouple fuel from convenience, with many of their attempts quickly shutting down. When we visited them, they often felt like carbon copies of traditional gas station c-stores, just without the fuel. The offers weren’t adapted for their new surroundings and lacked the context that made them work in the first place.

"When you look at what makes fast-growing super regionals successful, it’s not that they redefined convenience or created a new category — it’s that they built better gas stations."

Frank Beard and Brandon Lawrence

C-store industry analysts

Some people point to food as proof that the industry’s identity is evolving into something new. But for millennials like us, gas stations have always had food. The Los Angeles Times wrote about this trend thirty years ago.

What’s changed is the quality — of the food, yes, but of everything else as well. The restrooms are cleaner, the lighting is brighter, and the staff are better paid with more opportunities to build careers. The convenience store of the future may look more like the gas station of the past, just a more elevated and technologically sophisticated version. Partly because the consumer is better informed and has more choice, the industry has to evolve.

When you look at what makes fast-growing super regionals successful, it’s not that they redefined convenience or created a new category — it’s that they built better gas stations.

Fuel is a vital traffic engine for this industry. It’s what justifies the corner real estate, the volume discounts, the labor model and the scale of the offer. Gas pumps are also, effectively, the only form of marketing that pays you. If someone invented a new device that could deliver 30 customers an hour and covered its own costs, it would be considered a miracle.

QSRs don’t have that luxury. They’re also locked into rigid identities. If tastes shift and someone convinces TikTok that burritos are over, Chipotle has a problem. Gas stations can pivot endlessly. QuikTrip has sold everything from pizza-filled roller-grill breadsticks to salads, pulled-pork tacos and take-home pizzas. Fuel provides the stability for retailers to experiment and take risks on everything from food to technology.

So no, fuel may not be the growth engine it once was, but it’s still the reason this model works.

Focus on what’s uniquely yours

Gas stations don’t need to copy QSRs or other cross-channel competitors to stay relevant — they already are relevant. But they do need to figure out how to do things with food and technology in a way that’s uniquely their own, building on strengths only this format can offer.

Casey’s pizza is a perfect example. It’s not the best pizza on the market, but it’s one of the best gas station pizzas on the market. It’s tailored to customers who need a quick grab-and-go slice, but it’s also easy to order for home or catering. As technology has evolved, so has its ordering process — from opening a phonebook and calling the store to tapping a few buttons on the app. And through it all, the pizza remains freshly prepared in each store’s kitchen with a distinct flavor that customers recognize.

This level of quality may be what ultimately defines gas station food. Operators like Parker’s Kitchen, Coen Markets, Clarks Pump-N-Shop, and Shop Rite’s Bourbon Street Deli are showing what the future could look like. While the QSR down the road might reheat a frozen egg disc, the gas station might be the place that cracks an egg on a grill. It’s a different kind of value, and it’s one built on fuel-driven traffic, close proximity to communities, and — for many — the advantages of hyperlocality.

We get why some flinch at the gas station label. We’ve all seen the headlines and experienced the worst operators. But the best in this industry have earned the right to reclaim the phrase. Besides, gas stations fuel more than cars. They fuel culture, community and the American economy. They symbolize freedom and adventure. Maverik rightfully built an entire brand around that idea.

So yes, keep innovating. Build what’s next. But don’t lose sight of what makes this channel work.

And while we’re at it, let’s go ahead and toss “mobility retail” in the trash where it belongs.