Now that the 2023 NACS Show has come to a close, the industry can reflect on the trends and ideas highlighted at the year’s biggest c-store event.

While topics like hiring and inflation remained at the forefront, the c-store industry’s increasing focus on artificial intelligence was notably stronger at this year’s show.

Here are the issues and ideas that stood out from this year’s show.

Labor is still the elephant in the room

Labor was arguably the most-discussed topic at the 2023 NACS Show. Although convenience retailers are adding new perks and automation tools to make things easier on their employees, hiring and retention continues to be a major challenge in the industry.

Labor is one of the biggest challenges Casey’s General Stores is facing, Chris Stewart, vice president of merchandising for the Iowa-based retailer, said during a panel discussion. The company has about 40,000 employees, and turnover remains “very high,” with about a quarter of its store managers leaving every year, he noted.

“Stability in the workforce to create a great customer experience is top of mind for me,” he said.

Employee churn also remains a problem for Baltimore-based High’s Dairy Stores, Brad Chivingston, senior vice president of retail for the company, said during a separate panel discussion. He noted that in 2024, minimum wage in Maryland will become $15 per hour, which will make High’s hiring and retention processes even harder.

AI has arrived

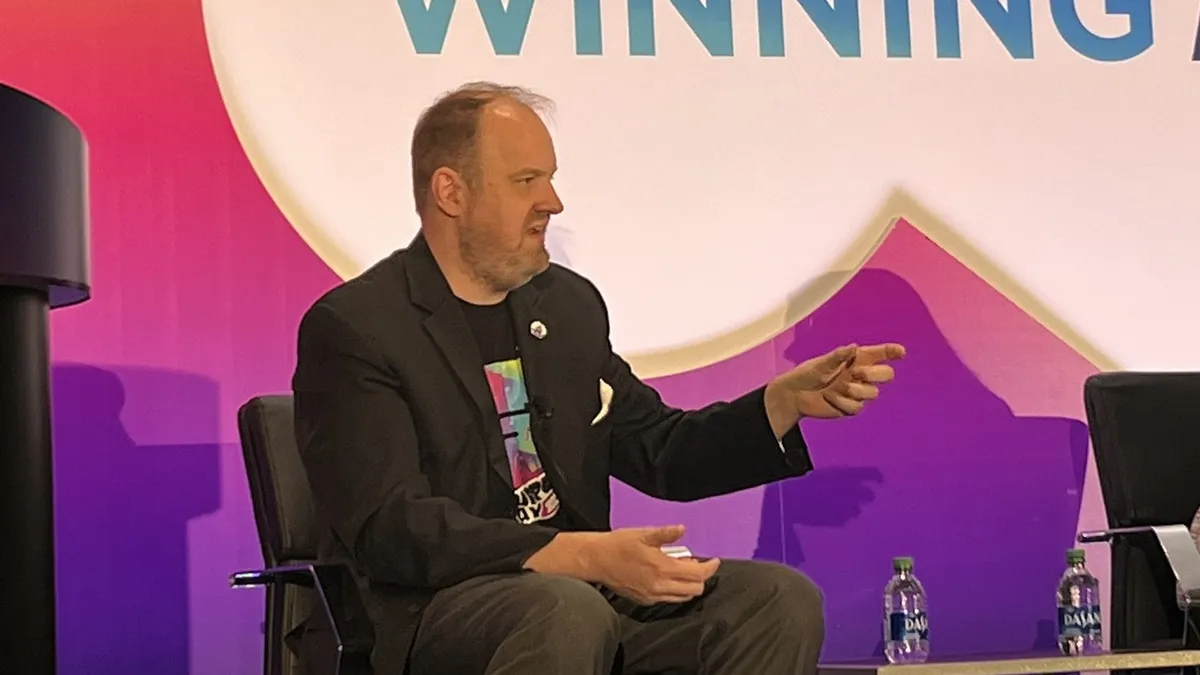

As expected, AI was a hot topic at this year’s NACS Show. During one of the education sessions, Brian Ferguson, vice president and chief merchant for Pilot Company, noted that convenience retailers don’t have to reinvent the wheel with the types of AI they use, but can instead look at retailers across other segments for inspiration.

“If you walk through a Walgreens or Sam’s Club or Walmart or Kroger, you don’t have to go very far until you see AI and technology in action,” Ferguson said.

Ferguson said Pilot uses AI tools for various store operation elements, such as demand and seasonality profiles, stock loss analytics and labor forecasting. He noted that while these tools are often helpful in reallocating staff to focus on customer-based tasks, getting team members on board can be difficult.

“I call it the cycle of pain,” he said. “Any new technology is viewed with a little skepticism, a little bit of a black box.”

Explaining to team members “the why” behind these new technologies — and affirming that it won’t replace any jobs — is key, he said.

Industry tech is evolving

On the topic of AI, the show floor had no shortage of inventive new tech products. From self-checkout kiosks to automated point-of-sale systems, vendors flocked to Atlanta to showcase their innovations for c-stores.

One standout product was the Smart Cafe from digital payment company Cantaloupe, which will arrive in spring 2024, a spokesperson for the company said. The Smart Cafe is a refrigerator or shelving unit built with AI and dynamic vision camera technology. Customers must swipe their credit card to open the unit, and once they grab their preferred item, they’re automatically charged.

Inflation continues to challenge merchandise sales

Convenience retailers have made strides in merchandise revenue over the past couple years, but with inflation continuing to rise, expenses remain difficult to rein in. That’s why every retailer has their own strategy to optimize their assortments.

For instance, Casey’s has about 500 different planograms for its 2,600-plus locations, which are based on a combination of sales data, brand penetration and each store’s location, Stewart said during his panel discussion.

Stewart also noted that Casey’s builds its assortment on an item-by-item basis regardless of what category each product belongs to.

“Because our stores are so small, every product has to pay the rent,” he said.

Buffalo-flavored snacks are in

Buffalo-flavored snacks seemed to be at every other booth on the expo floor. Some products included buffalo-flavored wild boar jerky from Pearson Ranch Jerky; Wild Buffalo Puffzels — a crossover between cheese puffs and pretzels — from Unique Snacks; and two soon-to-be released snacks from Kellogg and Pepsico, Scorchin’ Buffalo Pringles and Buffalo Cheetos, respectively.

The Scorchin’ Buffalo Pringles deliver 7,000 Scoville heat units per can, according to information from Kellogg. This snack, as well as other buffalo-flavored items, represent the increased demand for spicy snacks among consumers, and especially Gen Zers, Dan DeMeyer, director of sales strategy for Kellogg, said in an interview.

Retail media is lurking

Last year, 7-Eleven became one of the first convenience retailers to launch a retail media network. Although the trend hasn’t quite taken off around the industry yet, the Irving, Texas-based company continues to evolve its retail media capabilities, and its Gulp Media platform remains a priority moving forward.

Among other takeaways, 7-Eleven has learned more about running and staffing a retail media team over the past year. Ben Tienor, 7-Eleven’s director of brand and customer insights, as well as the director of Gulp Media, said during a panel discussion. He noted that the Gulp Media team “is very outsourced at the moment,” with its agency partner doing the selling and media planning execution.

Tienor suggests c-stores starting out in retail media must consider how much they want to leverage a third party when building their programs.

Smaller players are evolving their foodservice capabilities

While large c-store retailers like Wawa and Sheetz are known for their made-to-order foodservice, small and midsize players are making noise in this space as well.

Baltimore-based High’s Dairy Stores, which operates 57 c-stores across Maryland, Pennsylvania and Delaware, has brought made-to-order fried chicken to nearly half of its locations since launching the option in 2017. The retailer also offers fresh pizza and hot and cold sandwiches at various locations, as well as items specific to the Chesapeake Bay region, like crab cakes and rockfish sandwiches.

Six years into its made-to-order program, High’s is still learning how to optimize its offerings, but realizes that foodservice is “a competitive piece that you have to have,” Brad Chivington, senior vice president of retail for the company, said during a panel discussion.

“It’s not a destination — it’s a journey. We’re figuring this out as we go along,” he said.

Nostalgic beverages are the talk of Gen Z

Convenience store consumers are craving beverages that spark nostalgia. Specifically, they want drinks that bring “unique twists on old favorites,” Jeff Tabor, senior vice president of small formats for Keurig Dr Pepper, said in an interview.

The beverage manufacturer pointed to its Strawberries and Cream Dr Pepper, which debuted earlier this year, as an example of this trend. Tabor also noted that the company will be launching a Sunkist Strawberry Orange variety next year.

Similar to DeMeyer’s note about spicy snacks, retailers and beverage manufacturers are targeting Gen Z consumers with this nostalgic trend, Tabor said