Keeping prices reasonable while offering a quality menu can seem like an uphill struggle. The industry continues to be plagued by inflation on food, packaging, cleaning supplies, labor and more, while ever-changing news about tariffs is concerning, at the very least. As a result, many c-stores are making changes in menu offerings, pricing, ordering and other logistics.

“At this point price fluctuations are the norm. Even if it's not tariffs, that doesn't mean that global supply issues won't still impact prices,” said Mike Kostyo, vice president of Menu Matters, a food industry strategic consulting firm.

"You have to create an operation that is both nimble enough to react to swings in pricing while also creating some stability in your operation so you aren't in constant reaction mode.”

Hold strong on star menu ingredients

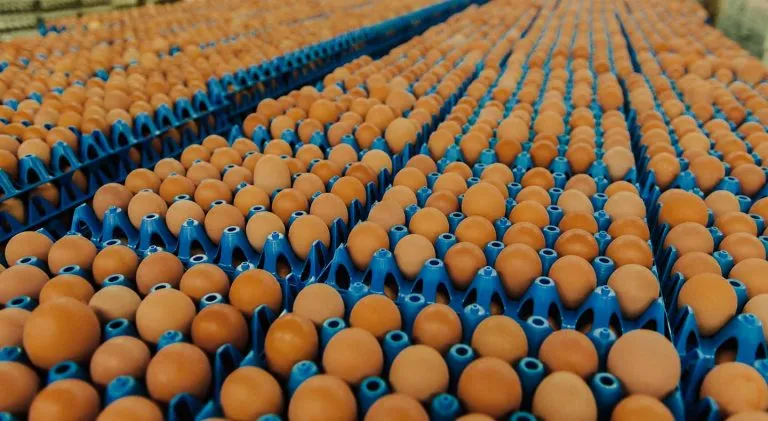

Eggs, coffee, ground beef and chicken — all important ingredients in c-store foodservice programs — have seen the biggest price increases in the past year, according to Matt Hautau, VP of merchandising for distributor Core-Mark, a division of Performance Food Group.

Egg prices have been the most notable, rising 72% in March versus last March, according to Circana, with the USDA projecting a 41% overall increase this year.

However, retailers and restaurants are “getting hit from all sides,” said Maeve Webster, president of Menu Matters.

“All ingredients have increased to various degrees, and when everything is increasing, then it almost doesn't matter which grow [the] most, unless they are a key component of a concept (like eggs for a breakfast place),” Webster said in an email. One way operators are counteracting that is by prioritizing the most important ingredients and making compromises on those that have less impact.

For example, while a breakfast program can’t do away with eggs, it may switch to cheaper dairy products or baking ingredients.

“It’s important patrons don't notice major changes, particularly on the foods they love,” Webster said.

Despite the higher cost of eggs, c-stores have continued emphasizing their lucrative breakfast programs this year — including deals such as EG America’s $3 breakfast value meal, launched earlier this year.

Some breakfast chains, including Waffle House and Denny’s, implemented surcharges on egg-based menu items.Where possible, some c-store operators have swapped to cheaper options like liquid eggs and plant-based options, Kostyo said, though he declined to name companies. Similarly, Core-Mark also said some clients have switched to egg patties or liquid eggs.

Beware of making menu cuts

C-store operators should not reduce breakfast offerings, since they remain a “critical sales opportunity for c-store customers,” Hautau advised.

Instead, c-stores can look at re-engineering menus or switching protein sizes to save on the cost of beef and chicken.

“We have encouraged customers to cross utilize the same ingredient across multiple menu items,” he noted. “For example, instead of ground beef, you can use a crumble sausage that works for both pizza and also breakfast burritos.”

And the increase in coffee costs can actually help c-store retailers stand apart from their competitors, according to Hautau.

“Coffee consumption is at an all-time high, and the demand is not going anywhere,” he said. “At the same time, the cafes and coffee houses are raising their prices to unbearable levels.”

C-stores can promote cheaper coffee and expand their customization options via flavored creamers or syrups, Hautau suggested.

C-stores can also diversify their sourcing for added flexibility, locking in price contracts for the long term if possible and having back-up ingredient swaps at the ready, Kostyo said.

How to ease the pain of price increases

Raising prices is an inevitability for any foodservice operator, so it is important to have a strategy in place to deal with those increases, Kostyo advised.

“Instead of locking yourself into a price point for a single item for years to come, maybe an ever-changing menu of $2, $3, $5, etc. items makes sense for you,” he said.

Operators may want to add something to the meal so that the price increase doesn't feel as painful. “And sometimes you just have to be honest with the consumer, who knows that prices are rising and just doesn't want to feel like another business is out to get them,” Kostyo said.

Instead of focusing on price, operators should create and message a winning total value proposition to the consumer, Kostyo said. "It’s not just about price and it never has been; it's about earning the price that you need to offer a menu option at. Do an audit of your brand and each menu item, then ask yourself what the total value proposition is, and whether the consumer sees that and agrees.”

For instance, younger consumers might be willing to pay $7 for a unique coffee. Options like added functionality — think prebiotic benefits in soda — or items with premium flavors and ingredients may also earn higher prices even in an economically tight environment.

“Do an audit of your brand and then each menu item,” said Kostyo. “Then ask yourself what the total value proposition is, and whether the consumer sees that and agrees.”