Even though it’s now in the past, convenience retailers aren’t forgetting what could have been one of the most monumental mergers in industry history.

Nearly a year after it announced its bid to acquire 7-Eleven parent company Seven & i Holdings, Alimentation Couche-Tard withdrew its offer in July. The Canadian retailer, which operates the Circle K banner, said a lack of engagement from Seven & i was a major roadblock to the deal, which would’ve included over 80,000 7-Eleven c-stores globally.

To call the deal gargantuan would be an understatement. In the U.S. — where Circle K and 7-Eleven are the two largest c-store chains — Couche-Tard would’ve added over 9,300 c-stores on top of its existing 6,700.

At the height of their merger talks, the companies publicly revealed that they’d begun identifying over 2,000 overlapping locations they could divest — as well as pinpointing possible buyers — to avoid potential antitrust pitfalls. Although talks fizzled, the c-store industry spent months pondering where these overlapping stores were located and who those potential buyers might have been, especially in the U.S.

It’s unclear what criteria the companies used to determine if sites were overlapping, but it turns out there are far more than 2,000 sites that sit within close proximity of one another.

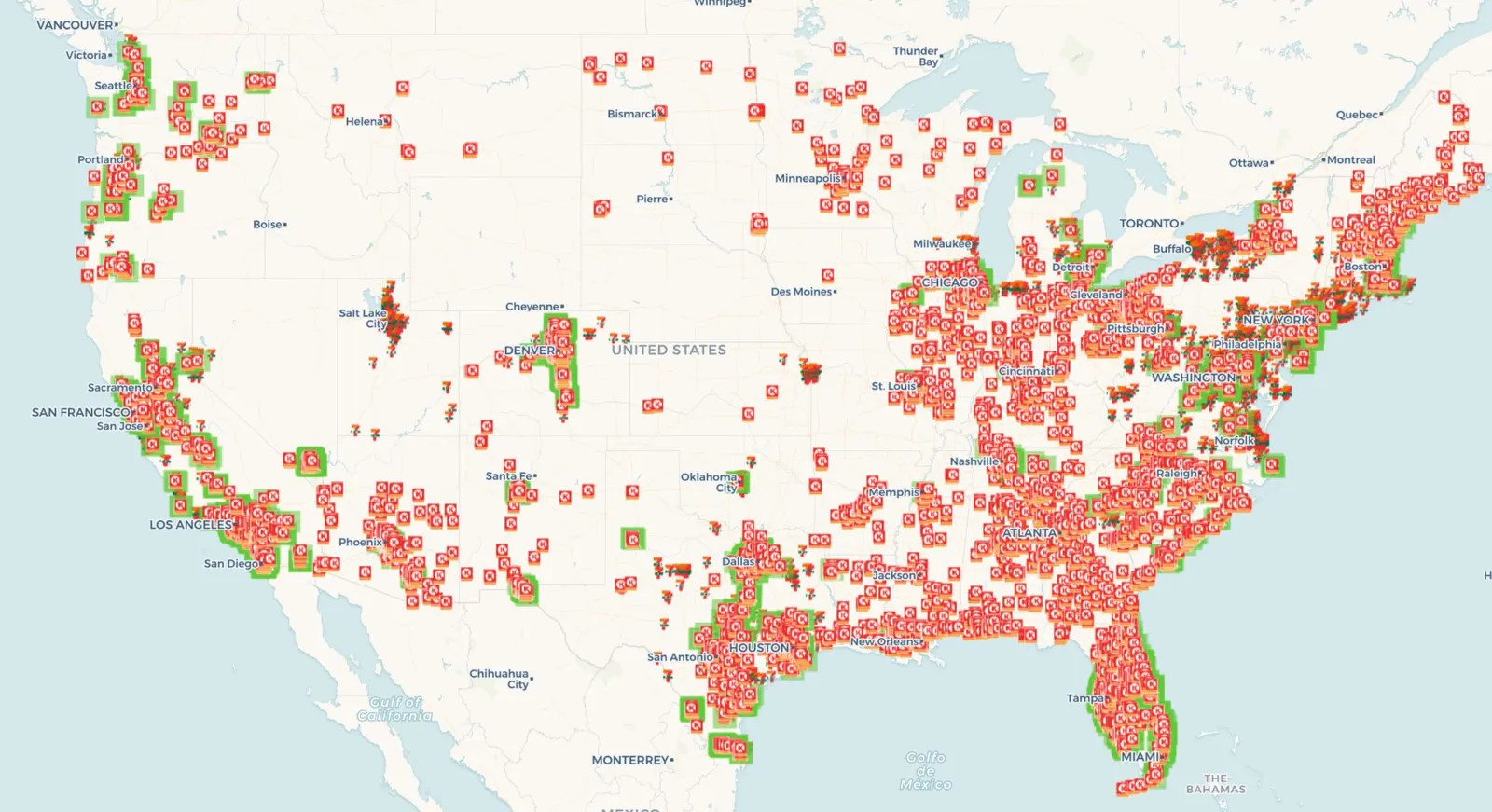

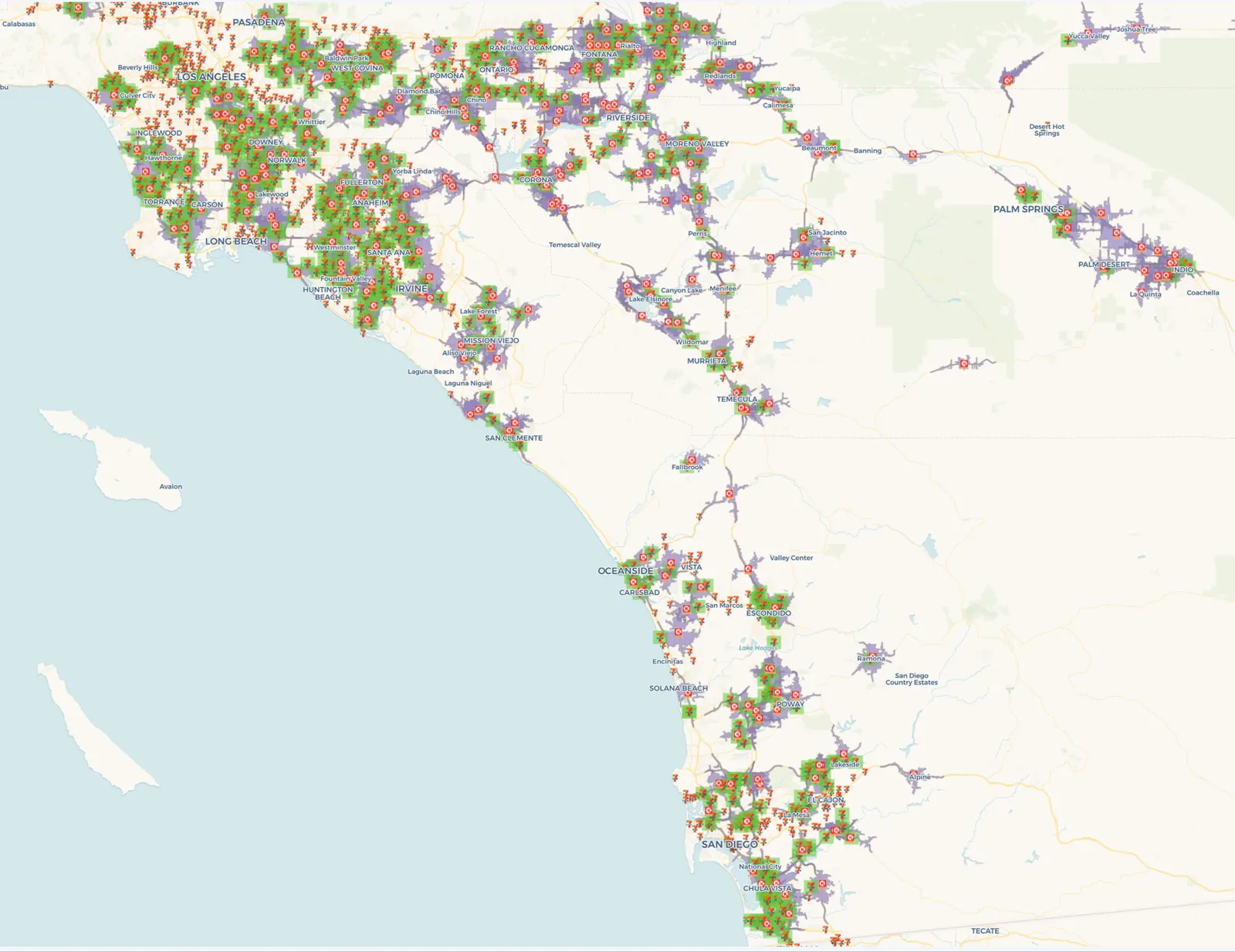

Specifically, there are 3,300 7-Eleven c-stores within a 5-minute driving radius of a Circle K across the U.S., according to mapping data by intelligence platform Locatium. Markets that see the most 5-minute driving overlap between the two retailers include South Florida, Central Texas and Southern California, as well as major cities such as Chicago, Atlanta, Phoenix and Denver, according to the dataset.

Locatium’s dataset combines U.S. roads and highways with isochrone mapping, which analyzes whether certain areas can be reached within a given time or distance. In this case, the isochrones calculate drive times between store locations and identify potential overlap or competitive tension between 7-Eleven and Circle K sites.

The dataset highlights stores that could have become part of the same network had the merger gone through, Fernando Carrasco, CEO and co-founder at Locatium.AI, said in an interview. It also represents locations that could have been sold off or relocated due to regulatory contractions, he added.

Although it’s only speculative for now, the data nonetheless paints a picture of how certain markets could have been impacted had the merger gone through. It also underscores just how closely the country’s two largest c-store chains compete in key markets.

For example, about 600 of the 1,100 c-stores 7-Eleven has in the stretch of California between Los Angeles, Palm Springs and San Diego are within a 5-minute drive of a Circle K, according to the dataset. And of the roughly 500 c-stores 7-Eleven has in Dallas — the retailer’s North American headquarters and one of its largest markets in the U.S. — about 260 of them are within a 5-minute drive of a Circle K, according to the dataset.

Despite the clarity of the dataset, Carrasco emphasized that it’s a “first-cut model,” focusing only on drive-time proximity, meaning that while it’s useful for preliminary insight, it shouldn’t be the only source used for strategic decisions.

To get a full picture when assessing competition and cannibalization efforts, c-store retailers should use “a wide range of variables beyond distance, such as location attractiveness, fuel pricing, in-store offerings, traffic patterns and brand strength,” he said.