Dive Brief:

- 7-Eleven has acquired Skipcart, a white-label delivery startup providing same-day and on-demand delivery, The Information reported. No terms or conditions of the deal were clarified, and neither company responded to a request for comment as of press time. Skipcart is valued at $65 million in 2020, according to The Information.

- According to the report, the deal will allow 7-Eleven to compete directly with DoorDash — which 7-Eleven has partnered with since 2015 — and Gopuff.

- 7-Eleven’s acquisition of Skipcart comes at the heels of convenience-store rival, Circle K, boosting its delivery portfolio earlier this summer — hinting at more partnerships to come between c-stores and delivery companies as c-stores become more foodservice-focused.

Dive Insight:

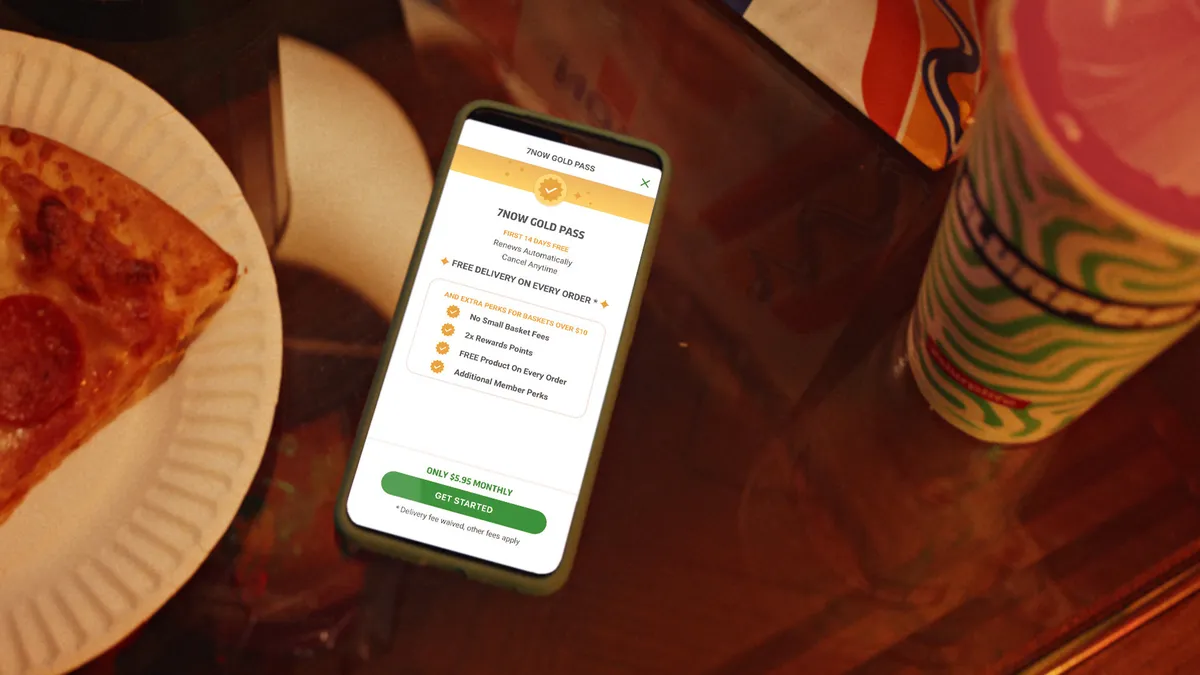

This isn’t 7-Eleven’s first foray into delivery. Prior to the Skipcart acquisition, the c-store chain had already offered delivery through eight different third-party services: Instacart, Uber Eats, Grubhub, DoorDash, Postmates, Google, Shipt and H-E-B-owned Favor, which only operates in Texas. 7-Eleven even completed the first Federal Aviation Administration-approved drone delivery to a U.S. address in 2016.

Through the current partnership between 7-Eleven and DoorDash, consumers can visit DoorDash’s mobile app or website to place their 7-Eleven order for delivery. According to The Information, although 7-Eleven intends to compete directly with DoorDash after the Skipcart acquisition, there is no indication 7-Eleven will try to offer more than their own inventory. However, the c-store has quite the range of products, allowing it to fight for diner dollars in both the restaurant and grocery space.

Beyond traditional snacks, candy, beverages and general merchandise, 7-Eleven also offers hot foods 24 hours a day, ranging from black bean burgers and fried chicken sandwiches to boneless wings and barbecue meatballs. In March 2021, 7-Eleven opened its first Laredo Taco Company drive-thru restaurant, which offers items such as beef barbacoa, chorizo, carne asada, carnitas and breakfast tacos, and can also provide Slurpees, hot or iced coffee and espresso drinks.

Founded in 2018, Skipcart offers delivery for brands in several industries, including food and beverage, grocery, restaurants, retail, electronics, POS systems, automotive and pharmaceuticals. In addition to 7-Eleven, other partners listed on its website include Hooters, Panda Express, Five Guys, Whataburger, Albertsons and United Supermarkets.

Skipcart has 2.3 million drivers in its network — covering 98% of the U.S. — and an average delivery time of 30 minutes, according to its website. To put that into perspective, as of December 2020, DoorDash had about a million delivery drivers, according to the U.S. Securities and Exchange commission. And the company told The Columbus Dispatch it added 1.9 million drivers between mid-March and September 2021.

Skipcart covering this much ground puts 7-Eleven in a good position to compete with Gopuff, which has eliminated thousands of positions this year amid challenging market conditions.

The timing of the deal between 7-Eleven and Skipcart isn’t far after one of 7-Eleven’s biggest competitors made noise in the delivery space. In April, Alimentation Couche-Tard, owner of Circle K — the second-largest c-store chain in the U.S., behind 7-Eleven — led a Series A funding for grocery delivery service Food Rocket, which guarantees delivery within 5 to 15 minutes — about half the time of Skipcart.

If you’re interested in more news covering the convenience store space, sign up for C-Store Dive, our newest daily publication, launching in the coming weeks.